Irs tax estimator 2022

IRS Tax Tip 2022-90 June 13 2022 By law everyone must pay tax as they earn income. Estimate your 2022 Return first before you e-File by April 15 2023.

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

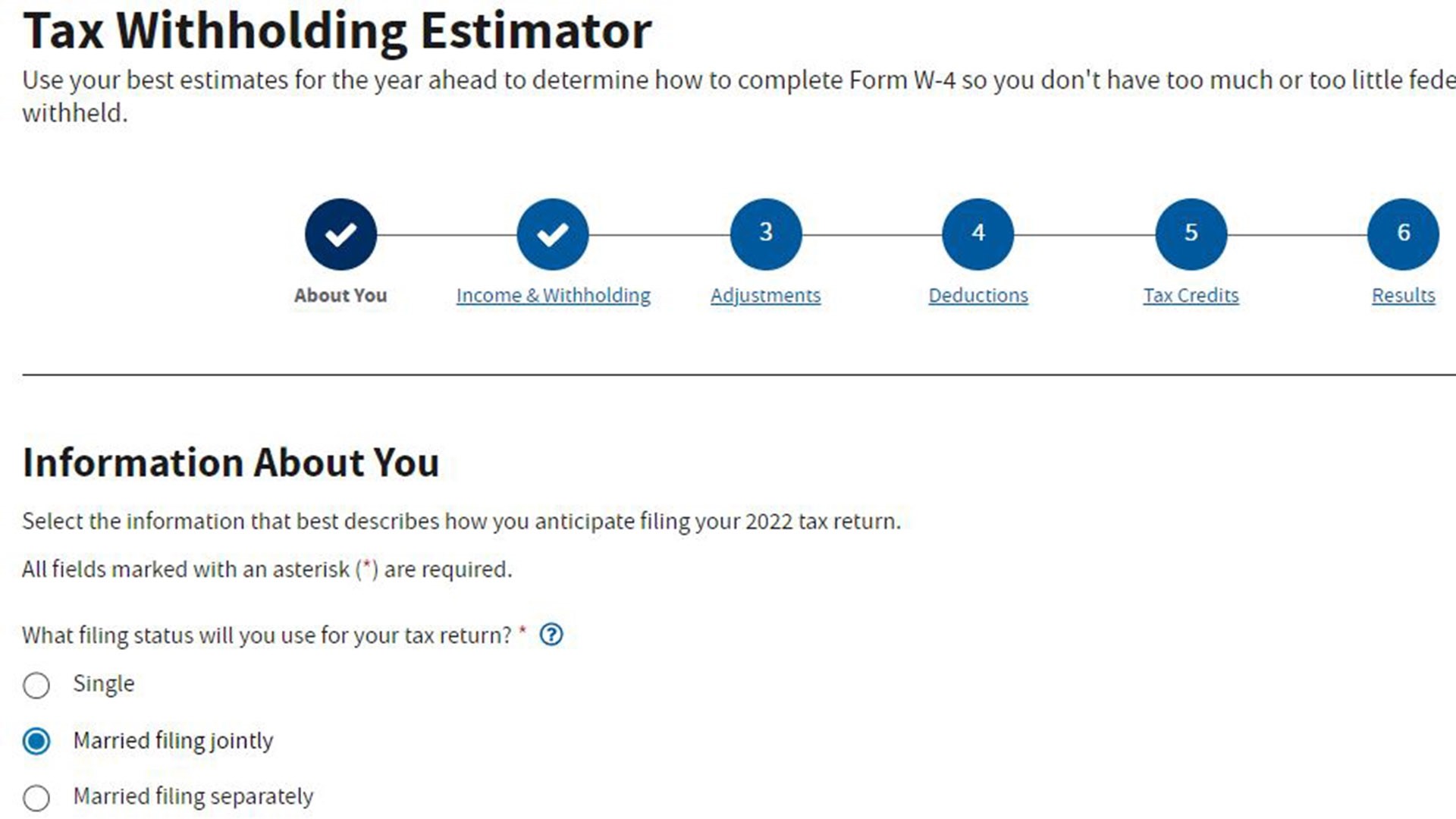

Start the TAXstimator Then select your IRS Tax Return Filing Status.

. Estimate your Tax Year 20232 - 01012023 - 12312023 - Taxes throughout 2022. By using this site you agree to the use of cookies. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available.

Most Americans are required to pay federal income taxes but the amount. Jan 01 2022 Use this calculator to estimate the amount of money that would be withheld from your monthly pension payments for federal income tax based on the IRS current tax tables and. Use the 2022 Tax Calculator to estimate 2022 Tax Returns - its never too early to.

Form W-4 Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct. You can also create your new 2022 W-4 at the end of the tool on the tax return result. There are seven federal income tax rates in 2022.

The total tax amount for vehicles reported on page 2 column 4. 0 Estimates change as we learn more about you Income. Easily and accurately calculate IRS State personal income taxes online.

The number of children they will claim for the child tax credit and earned income tax credit. IRS Tax Withholding Estimator helps taxpayers get their federal withholding right IRS Tax Tip 2022-66 April 28 2022 All taxpayers should review their federal withholding each. Be Prepared When You Start Filing With TurboTax.

You can also create your new 2022 W-4 at the end of the tool on the tax. Tax Calculator Return Refund Estimator 2022-2023 HR Block How it works. IRS Income Tax Forms Schedules and Publications for Tax Year 2022.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The top marginal income tax rate. It is mainly intended for residents of the US.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is.

January 1 - December 31 2022. Estimate Today With The TurboTax Free Calculator. The IRS again eases Schedules K-2 and K-3 filing requirements for 2021.

TIP Jan 24 2022 Cat. Our tax system depends on everyone paying. Use this calculator for Tax Year 2022.

This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. Use the 2022 Tax Calculator to estimate 2022 Tax Returns - its never too early to. IR-2022-77 April 6 2022 WASHINGTON The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals retirees investors.

Benck failed to report 31300 in income for tax year 2014 131400 for 2015 and 93035 for 2016 causing a tax loss to the IRS of 84092. Calculators IRS Penalty Calculator. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. The Tax Withholding Estimator asks taxpayers to estimate. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. IR-2019-110 June 12 2019.

And is based on the tax brackets of 2021 and. You can use the Tax Withholding Estimator at IRSgovW4App to determine whether you need to have your withholding increased or decreased. No More Guessing On Your Tax Refund.

Ad Plan Ahead For This Years Tax Return. Answer a few simple questions. Generally taxpayers must pay at least 90 percent of their taxes throughout the year.

Partner with Aprio to claim valuable RD tax credits with confidence. Its important you adjust your tax withholding as early as possible so you dont give. 2022 Tax Return Estimator Calculator.

Irsnews On Twitter Check Your Tax Withholding Today To Determine If You Need To Make Adjustments And Avoid An Unexpected Tax Bill When You File Next Year The Irs Tax Withholding Estimator

Infographics Will I Owe The Irs Tax On My Stimulus Payment

10 Top Coinbase Tax Calculator The Best Tax Calculator In 2022 Cryptoshot In 2022 Irs Tax Forms Irs Taxes Tax

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Irsnews On Twitter There S Still Time To Increase Or Decrease Your Tax Withholding For 2022 Get It Right With The Irs Tax Withholding Estimator Https T Co 3fqslsyht3 Https T Co Fveyowqkis Twitter

Virginia Society Of Tax Accounting Professionals Irs Tax News

Save Your Money How The Irs Tax Withholding Estimator Works 10tv Com

Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca

Tas Tax Tip Paying The Irs Tas

Form W 4 Employee S Withholding Certificate 2021 Mbcvirtual In 2022 Changing Jobs Federal Income Tax Internal Revenue Service

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The Irs Made Me File A Paper Return Then Lost It

Online Tax Withholding Estimator Revised By Irs Nstp

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms